Thank you CreditRepair.com for sponsoring this post. CreditRepair.com’s group understands that a credit history rating is not just a number it is a life style.

Credit is definitely the kind of point that when you have to have it, you really will need it. You hear it around and around yet again – make confident you have fantastic credit and preserve a very good credit score score. And if you have ever tried out to utilize for a vehicle financial loan, lease an condominium or store all around for home home finance loan you know how crucial it is. Acquiring a good credit rating score implies when you do go and apply for those loans, you will be authorised with lower desire premiums which based on the dimensions of the personal loan can conclude up preserving you countless numbers of dollars in excess of the lifetime of the mortgage. Lessen credit history scores, typically arrive with mortgage denials and even if you do get approved they come with substantially larger fascination rates. That signifies a ton more dough out of your pocket in the long run.

But we’re all human and errors with our credit rating can take place if we’re not watchful. It did to me. I have normally been vigilant about preserving my credit rating cards paid and on time to maintain a wonderful credit history score. But about two many years back I was in the middle of a move and a credit rating card I experienced on autopay elevated the minimal regular monthly payment on the card with no my understanding and devoid of notifying me (indeed, they can do this and there are no regulations halting them). Even nevertheless payments were being designed, considering the fact that the new minimum payment wasn’t becoming happy it was then thought of late. I had no idea. This corporation submitted a 30-working day late payment mark against my credit score and refused to clear away it even although they eliminated all charges, acknowledged there was no conversation and apologized for the scenario.

Even just after yrs of wonderful payment history, this one particular very little miscalculation prompted a huge 65+ point dip in my credit. And after your credit dips you promptly notice how it affects just about every aspect of your money lifestyle and monetary independence. Until you have the funds you can no more time just go out and get a household or automobile or home. The truth is that decreased credit score scores can expense you huge $$$. Immediately after diligent do the job, I’m nearly again to the credit history score I once experienced of 750+. The good news is our credit score scores are not set in stone and it’s under no circumstances also late to get it back again on keep track of.

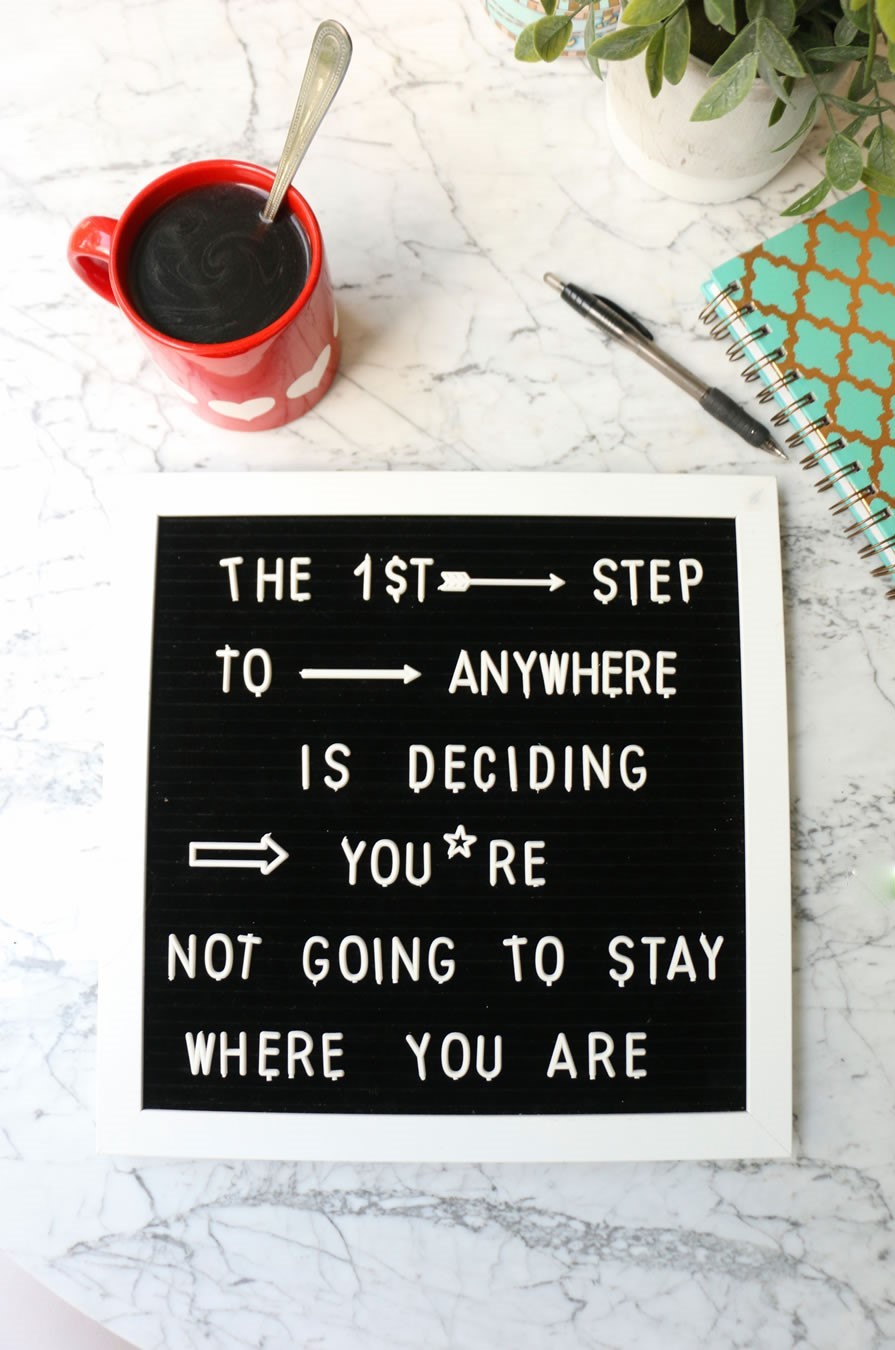

If you’re on the lookout to rebuild or restore your credit listed here are some guidelines to getting your credit score soaring once more.

Regrettably, acting as if your credit rating does not exist isn’t likely to make it any improved. The to start with detail to do when you make the final decision to maintenance your credit is to get your credit score report to come across out what your scores are and what if any unfavorable marks you could have. The Federal Trade Fee has built a regulation identified as the Fair Credit history Reporting Act (FCRA) that will make you entitled to a person absolutely free duplicate of your credit history report just about every 12 months. It will have all three nationwide credit history reporting companies scores and give you the information and facts you want to get started on your credit score maintenance journey. Even if you know you’re doing every thing suitable, there may well be information and facts on there that isn’t correct and affecting your score.

This 1 may well appear noticeable, but it’s the variety a person very best routine when either striving to raise your score or continue to keep it on track. If you discover it hard to try to remember when your credit rating card payments are thanks, established up alerts on your cell phone or mark a calendar on your wall. Placing up autopay for as several payments as doable can enable preserve you on keep track of as well. But even with autopay be confident to find out from my blunder and check out in with your accounts to make absolutely sure they are getting processed appropriately. And bear in mind you do not require to carry a month-to-month credit card equilibrium to establish your credit score. Paying out off your credit score card charges every thirty day period can have just as efficient.

Normally, when I listen to words and phrases like “report” or “monitoring” I commonly get started daydreaming about my weekend ideas. But pay attention to this…to get your credit score activity on stage you want to know what you are operating with. And that implies finding alerted to any changes (great and negative) to your credit score. To make points easy (we like uncomplicated) CreditRepair.com’s credit score monitoring technologies which supplies their customers with a own on-line dashboard, a credit history rating tracker and investigation, creditor and bureau interactions, with text and email alerts, cellular applications and credit score checking.

Insane Credit Reality: Proper now tens of millions of Us residents have inaccurate or unfair adverse things on their credit rating stories that are wrongfully hurting their score.

4. Change Your Spending Behavior – End Whipping Out That Credit rating Card to Acquire Espresso

Credit history playing cards are fantastic to have, but if you are maxed out or close to maxing them out your credit rating will go through. Loan providers ordinarily like to see reduced utilization ratios of 30% or less. That means if you add up the whole credit rating traces throughout all your credit rating card lines, everything in excess of 30% can negatively influence your credit score. That also signifies stop utilizing them frivolously for every day frivolous points like espresso. In point, just quit utilizing them unless of course it is an complete and overall unexpected emergency. And no, finding entrance row Taylor Swift tickets or that new $200 of constrained edition sweatshirt that is most definitely going to be crumpled up in the bottom of your closet a few months from now are not emergencies. To maintain from employing them virtually just take the credit history playing cards out of your wallet and place them in your nightstand or a locked box so you aren’t tempted.

I get it. You want to get serious about your funds and boosting that score. But did you know closing out credit rating card accounts when you nonetheless have a balance can harm your rating? Do you know that utilization score we just dished about? Canceling out cards will decrease your total readily available credit score total though boosting your credit score utilization which can usually reduce credit history scores.

A smarter credit score-creating system is to retain unused card accounts open and not employing them when shelling out some others down.

There is a lot of points that variable into how your credit rating score is calculated together with payment historical past, credit rating duration, balance quantities, irrespective of whether you have a mix of credit score (credit history playing cards are various than a mortgage loan, university, and car or truck financial loans) if there is any damaging stories and more. Notice that though it may possibly just take months for some to construct their credit history, it could choose a year or two or much more for some others. The most critical point is committing to economical liberty and having cost of your credit history score to get back again on keep track of.

When a fantastic credit rating rating can be important in encouraging you realize some of your life’s monetary and life-style aims it is even now just a number. With time and a tiny diligence on your section, it will get better in excess of time. Sure, a excellent credit score can just enable you accomplish your dreams and dwell your daily life a small extra. But it is not prepared in stone are you are much more than a credit score rating. If you want to deal with your credit but truly feel confused, call CreditRepair.com for a free consultation. With more than 500,000 clientele already served, they have specialists that can aid guideline you through the baffling and at times annoying credit history fix procedure.

What is your terrible credit rating is costing you?

CreditRepair.com is a reliable leader in credit mend! Take a look at them these days to begin climbing again to the top rated. Know your credit, restore your reviews & dwell your daily life.